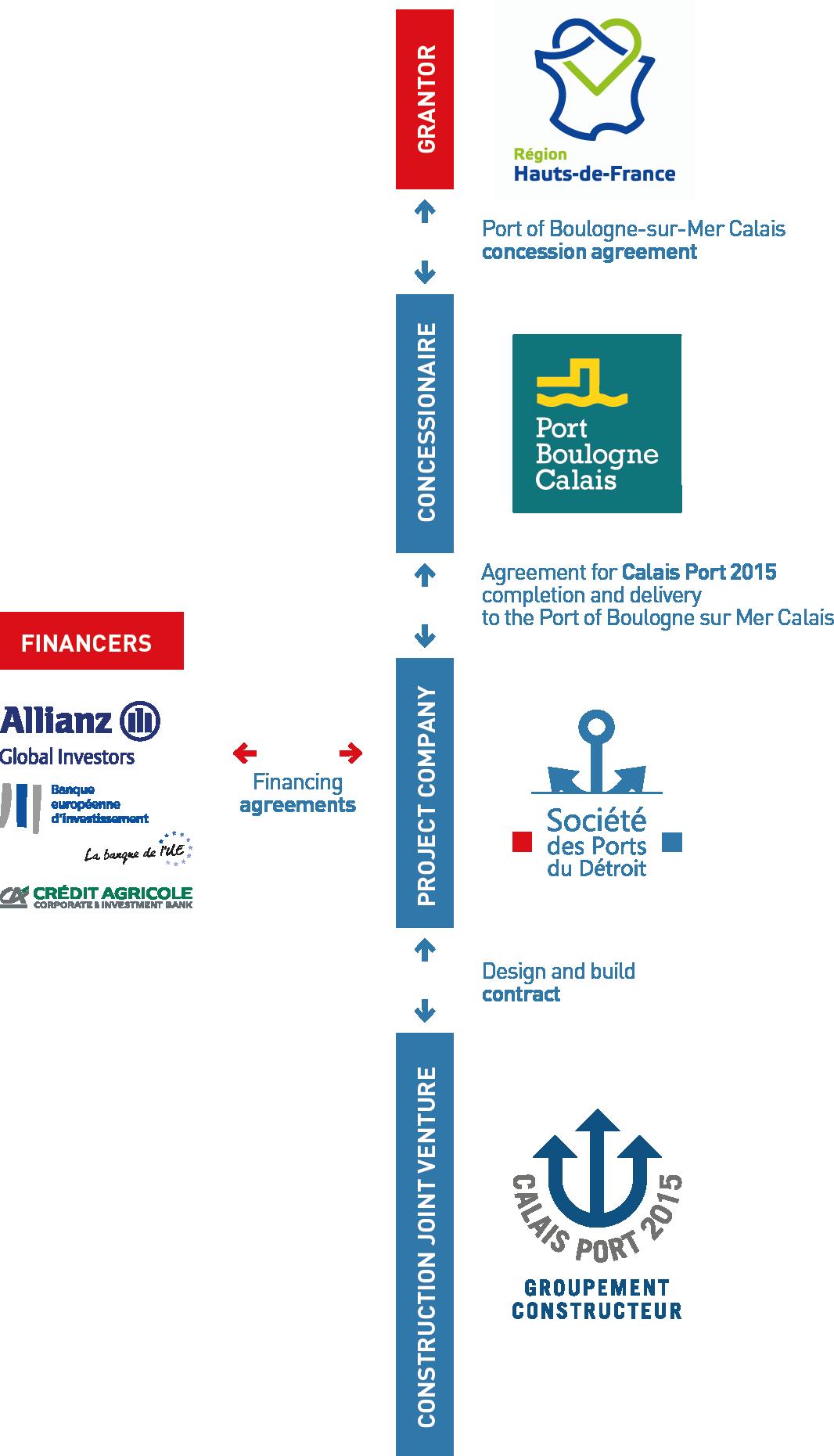

Based on two companies created for this purpose, an innovative contractual framework has optimized the financing particularly regarding the required level of public subsidies.

Under a public service delegation contract for a 50 year period, the Hauts-de-France Nord Pas de Calais - Picardie Région asked Société d’Exploitation des Ports du Détroit (SEPD) to take charge of the management, operation, maintenance and development of infrastructure of Boulogne-sur-mer and Calais ports (including work related to Calais Port 2015 project).

SEPD sub-delegated all work related to Calais Port 2015 management and financing and major maintenance over the contract, to Société des Ports du Détroit (SPD). For an infrastructure delivery planned to take place in January 2021, SEPD will pay the SPD an availability fee.

This structure allowed a clear allocation

of risks between all partners involved.

Société des Ports du Détroit supports the financing and the industrial performance risks (time and cost to build Calais Port 2015, heavy maintenance and renewals). The traffic risk is supported by Société d’Exploitation des Ports du Détroit. This clear risk allocation allowed a very long term funding adapted to the marine infrastructure depreciation period and optimized the required level of public subsidies.

This risk allocation matches the difference between both companies’ shareholders. On the one side, the Chambers of Commerce, with a long tradition of port operators, are shareholders up to 78 % for the SEPD whereas on the other side, both investment funds, CDC Infrastructure and Meridiam Infrastructure, specializing in major infrastructure construction and maintenance, own 80 % of the SPD shares and lend the SPD 100% of its subordinated debt.